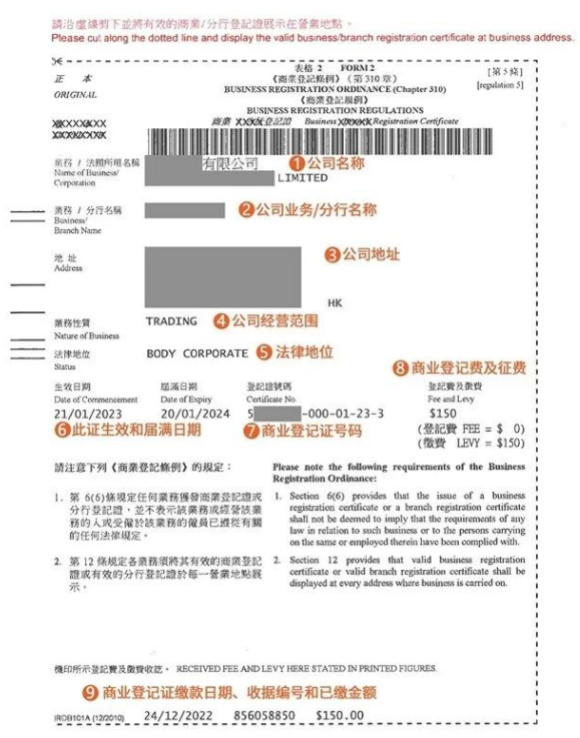

香港公司商业登记证里面都包含哪些信息? 1、香港公司名称 2、公司分行名称(如有) 3、公司注册地址 4、公司业务性质(即经营范围) 5、法律地位 6、商业登记证的生效日期和届满日期 7、商业登记证编号(也叫税号,向税局报税的号码) 8、商证的登记费及征费(依[…]

Author Archives: admin

HONG KONG BANK ACCOUNT OPENING – 4 STEPS ONLINE SETUP

Remote Account Opening If your business is set up in Hong Kong and your wanted to open a business bank account. Then most of the bank can provide remote account opening platform via your mobile phone app. Thus, you can apply anytime, anywhere by using the remote account opening service. Step 1 Visit your preference …

Continue reading “HONG KONG BANK ACCOUNT OPENING – 4 STEPS ONLINE SETUP”

香港公司秘书和私人秘书的区别

说到公司秘书,大家第一时间都会觉得,秘书就是订机票、买花或者整理文件之类的职位。 但如果你注册一家香港公司的话,公司秘书其实是一家代理公司。如你想成功注册到香港公司的话,公司秘书是不可或缺的一环哦。 [公司秘书]的作用 1、每年更新一次商业登记证。 2、每年填[…]

香港有限公司与中国有限公司的区别

香港虽然受中国管治,但是香港有限公司和中国有限公司之间存在着巨大差异,主要是因为两者之间的法律、监管和商业环境各不相同。 法律制度 香港实行普通法法律体系,它强调司法独立、保护财产权和遵循先例。 中国实行社会主义原则的法律体系,以法规和条例为基础,司法判决不具[…]

英属维尔京群岛公司

英属维尔京群岛(BVI)是创建国际商业公司最受欢迎的地方之一。因为它是众所周知的避税天堂。因此,英属维尔京群岛公司注册无疑是实用的,公司可以为了避税在该地注册离岸公司。英属维尔京群岛离岸公司没有企业所得税,资本收益税为零,也没有增值税(VAT)。如今设立 BV[…]

CHINA: TRADEMARK APPLICATION AND APPEAL

China is a “first-to-file” jurisdiction, it means you have to register a trademark in order to obtain proprietary rights. So, if you are planning to start your business in China, Centre O would strongly recommend to register your China trademark as soon as possible. As it’s mostly ended up with squatters, counterfeiters, or grey market …

中国商标申请和申诉

中国是一个“申请在先”的司法管辖区,这意味着你必须先注册商标才能获得所有权。因此,如果你打算在中国开展业务,Centre O 强烈建议你尽快注册你的中国商标。否则,很可能会遇到商标抢注者、假冒者或灰色市场供应商。 申请中国商标需要哪些文件? 申请 首先,您必须[…]

THE BRITISH VIRGIN ISLANDS COMPANIES

The British Virgin Islands (BVI) is one of the most popular places to create an international business company. Since it’s well-known as being a tax haven. Hence, BVI company registration is no doubt practical, making it one of the offshore tax havens. BVI is no corporate income tax, zero tax on capital gains, or value-added …

为什么在香港创业如此容易?

香港创业相对简单快捷,设立成本低,整体环境鼓励企业蓬勃发展。香港是全球最适宜创业的城市之一。星特奥始终致力于为香港和中国的企业提供协助和便利。在香港创业相对容易的原因: 简单的注册流程 香港的企业注册程序简单高效,在业界享有盛誉。此外,负责企业注册的公司注册处[…]

THE BUSINESS REGISTRATION FEE AND LEVY 2024-2025

2024-2025 the Business Registration Levy HK$220 will be waived per annum. While the registration fee will no longer be discounted. Starting from 1 April, 2024, the Business Registration fee is HK$2200. How much you have to pay in 2024-2025? Checking back, the calculating of 2023-2024, the amount of total business registration fee HK$2000, plus levy …

Continue reading “THE BUSINESS REGISTRATION FEE AND LEVY 2024-2025”