When establishing a Hong Kong Limited Company, one critical factor to consider is the company’s share structure. Selecting the right directors and shareholders can not only facilitate business growth but also enhance governance stability and attract potential investors. If your business has multiple shareholders, drafting a comprehensive shareholder agreement is essential to prevent disputes in the future. So, what key elements should be included in your shareholder agreement?

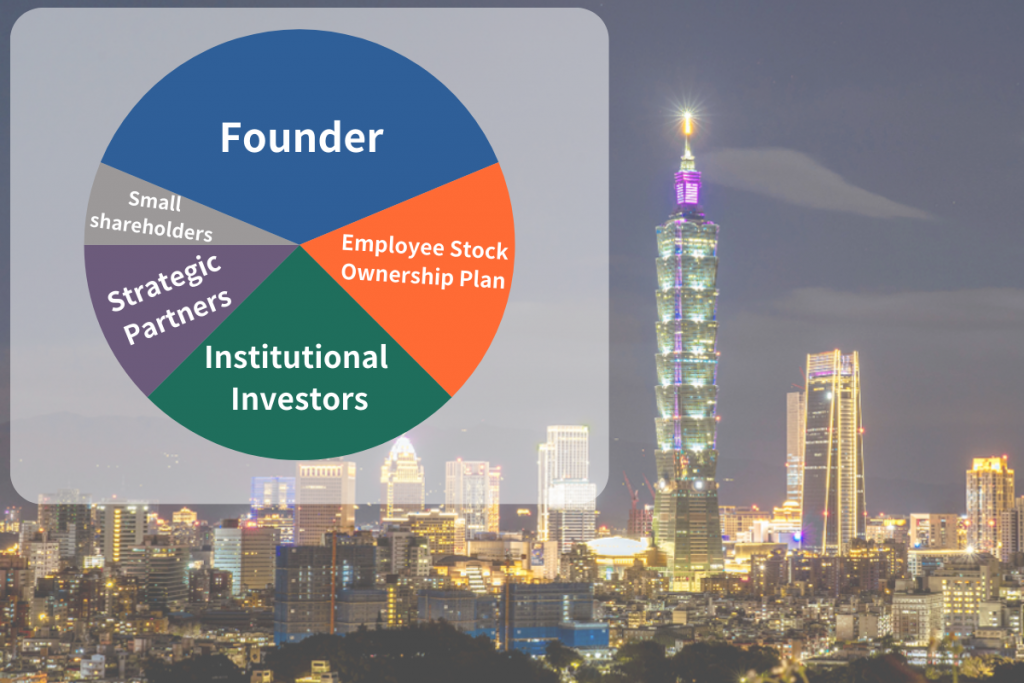

Share Percentage:

Clearly outline the ownership stakes for each shareholder to avoid ambiguity.

Responsibilities:

Define the roles and responsibilities of each shareholder to ensure accountability.

Liabilities:

Address individual liabilities to clarify financial duties among shareholders.

Funding Contributions:

Specify the amount of funds each shareholder is expected to inject into the company.

Exit Strategy:

Plan for how shareholders can exit the business, whether through sale or transfer of shares.

Adding New Shareholders:

Establish guidelines for integrating third-party shareholders into your company.

Dividends:

Detail how and when dividends will be issued to shareholders.

Company Closure: Outline procedures and costs related to the potential deregistration or winding down of the company.

It’s important to note that while Hong Kong Limited Companies aren’t mandated to have paid-up capital, many agents opt to register companies with a single share valued at HK$1. At Centre O, we strongly recommend consulting with your agent about increasing capital options during registration. This foresight can prevent complications when needing to issue new shares for future investors. Keep in mind, share values become public information, influencing the trustworthiness of your business in the eyes of clients and suppliers. For tailored advice on your company’s share structure, feel free to contact us.

You may want to read: New Companies Ordinances P.2: Changes to Share Capital and Directors