当你在香港挑选公司名称时,你必须预先检查该公司是否适合注册。否则,注册可能会被拒绝。结果是重新申请并再次付款。

注册前需要得到注册商批准的理由?

如有下列情况,您可能需要在注册前获得批准:

该名称给人以任何方式与香港特别行政区政府或中央人民政府或任何政府机构或部门有联系的印象。只有当该公司与政府有真实联系时,注册商才会批准该公司名称。否则你不能使用“政府”等词(政府),“部门”(部門),“局”(局),“权威”(委員會),“委员会”(議會),或“委员会”(公署)。”

如该名称含有《公司(公司名称内的词语)令》(第622A章)所指明的任何词语或措词。例如:“商会”、“街坊”、“征款”、“信托”、“受托人”。

如果您使用的名称与注册主任根据《公司条例》(第108、109或771条)通知更改名称的名称相似。注册主任可根据前任条例第22或22A条要求更改公司名称。

注册商发现名称误导了公司活动的性质。如果不符合公众利益,他们可能会要求在规定期限内改名。

如需进一步信息,请与我们联系。

“返港2”-大流行期间的旅游计划

“返港计划”是指香港居民从内地或澳门返港时可获豁免实施强制检疫的计划。我们知道,14天或21天的酒店隔离不是一个笑话。酒店隔离与休闲酒店度假完全不同。所以,如果你可以避免酒店隔离,你最好充分利用你的权利。

谁可申请“返回香港”计划?

年满十八岁并持有有效香港身份证的香港居民。

18岁以下的香港居民必须与父母或监护人一起申请。

在内地逗留至少14天后返港。而且这个地方也没有说要强制隔离。

政府授权医院或检测机构出具的72小时阴性检测报告。

什么是入境手续?

前往香港前24小时内。您需要将有效的PR-PCR核酸检测阴性结果通过“悦康码”发送至卫生署电子健康申报系统。

在返港当日,请携同身份证及阴性化验结果,以便核对。虽然电子或纸质报告都可以接受。电子副本将缩短通关程序的时间。

绿色的二维码

如你有“Return2HK”的配额,并符合所有指定条件。然后卫生署的电子健康申报系统就会生成一个绿色二维码。“Return2hk绿码”可方便出入境管制站的人员识别。

粉红色的二维码

如卫生署电子健康申报系统生成粉色二维码。那么您可能还没有满足所有Return2HK指定的条件。例如:

你没有在入境日期持有有效的返港配额。

您位于内地或澳门的高风险地区

您没有有效的RT-PCR核酸检测阴性证明。

你的报告不是由公认的医疗机构出具的。

您忘记将您有效的PR-PCR核酸检测阴性结果发送到电子健康申报系统。

如果您没有绿码,您将在入境时接受强制检疫。

如需进一步信息,请与我们联系。

香港驻广东经济贸易办事处

大多投资者在中国创业时都犹豫不决,其中包括许多在香港设立公司的公司。一般来说,他们对中国企业的政策法规信息不够全面。在过去的几年中,香港政府在中国大陆设立广东的香港经济贸易办事处(GDETO)。总的来说,这是建立企业的桥梁,将中国大陆和香港联系起来,帮助企业家建立和扩展业务。

香港驻广东经济贸易办事处的背景

香港政府于2002年7月成立了首个GDETO。自那时以来,总共建立了五个办事处,为促进香港与中国之间的紧密联系。 GDETO涵盖了福建,广东,广西,海南和云南。为了加强和深化与深圳、福建、广西的联络与合作,香港政府随后成立了深圳联络处,福建联络处和广西联络处,加强对跨境创业者提供更好,更快捷的服务。

GDETO负责处理香港与五个省/地区之间的经济和贸易事务。实际上,GDETO有助于促进香港的经贸利益。而GDETO则试图吸引直接投资进入香港。该办公室执行以下职能:

任务

1 /经贸联络

为进一步发展和促进香港与五个省、区的经贸关系。加强与省政府和有关地方当局的沟通与合作

2 /加强五省、地区与香港政府之间的了解

GDETO是加强经济和贸易发展信息交流的平台。

3 /对香港企业的支持

GDETO将加强与在五个省/地区开展业务的港商之间的沟通。通过获取和传播有关省级政策和法规的信息来提供更好的支持。这些信息与商业和贸易及其最新的经济发展有关。香港商人普遍关注的与贸易和贸易有关的问题。 GDETO将把他们转交给相关部门,并进行后续讨论。但是,它无法就个别商业和法律纠纷进行仲裁;

4 /招商引资

GDETO提供信息和服务,以促进从五个省/地区到香港的投资;

5 /推广香港

GDETO将树立香港作为良好商业伙伴的正面形象。

6 /协助遇难的香港居民

GDETO向五个省/地区的遇难香港居民提供切实可行的救助;

7 /护照更换服务

GDETO为符合有效香港特别行政区永久性居民身份证的合资格申请人提供香港特别行政区护照补领服务。

成就

粤港经贸关系

香港是广东省的主要外资来源地。 2018年,广东省新设立港资企业31,018家,占全省的86.7%,实际吸收香港资本995.2亿美元。

广东省在港投资企业数:6827家,投资额951.51亿美元

在香港上市的广东企业数:238家,总值7,727亿美元

香港与广西经贸关系

香港也是广西省的主要外资来源。截至2018年底,广西地区批准的香港资企业总数达到6884家,占该地区外资企业总数的60.7%。香港公司的直接投资额接近272.05亿美元,占总面积的58.7%。

香港与海南经贸关系

香港也是海南省的主要外资来源。截至2018年底,海南区批准的香港外商投资企业总数达到6438家,占该地区外资企业总数的59.9%。香港公司通过合同直接投资近390亿美元,占总面积的59.8%。实际直接投资为66.9亿美元,占总面积的65.6%。

香港与云南经贸关系

香港是云南省的主要外资来源。截至2018年底,云南地区批准的香港资企业总数达到1877家,占该地区外资企业总数的38.2%。香港公司通过合同直接投资近225.3亿美元,占总面积的63.8%。实际直接投资为124亿美元,占总面积的61%。

香港与福建经贸关系

香港还是福建省的主要外资来源。截至2018年底,香港投资者设立了27,400多家企业。直接投资620.7亿元。福建对香港出口总值502.9亿元人民币。

异象

自GDETO成立以来,它一直致力于为投资者提供各种各样的服务,包括:

推广香港

举办展览及其他推广活动,向内地居民介绍香港的最新情况。旨在加深对香港的全民认识和了解。 GDETO积极鼓励内地企业利用香港作为进入国际市场的跳板。由此香港积极的国际形象很受欢迎。

GDETO新闻稿

GDETO会在每个星期五发布“ GDETO通讯”。该新闻通讯包含有关商业和贸易相关政策/条例以及各省/地区经济发展的最新信息。并且在五个省/地区举行的重大经贸活动。

与经济和贸易有关的出版物/传单

GDETO制作并定期更新各种出版物/传单。该出版物帮助香港商人获取最新的经济和贸易相关信息。此外,这些刊物连同参考资料,均送交香港主要商会、半政府机构及内地有关部门。

与香港工商业协会负责人的聚会

GDETO组织“与香港工商协会负责人的聚会”,为了与香港主要行业协会的主席/主席保持直接沟通。希望能更好地了解其成员在该地区投资时遇到的问题。还可以评估协会对五个省/地区的投资和商业环境的看法。这些聚会还旨在征求行业协会的意见和建议,以便更有效地为香港商人提供服务。

传达香港企业对共同关心的问题的看法

GDETO一直在积极监督政策法规的执行情况,然后GDETO将采取适当的后续行动。包括香港商人对五个省、区有关部门的共同关心的问题。

到五省/地区的考察团

考察团的目的是向参与者介绍最新的经济/贸易发展情况和投资环境,以及帮助他们与当地政府和商业团体建立联系,以促进他们的投资和开拓商机。

研讨会

为了加深香港投资者对与经济和贸易相关政策法规和投资环境的认识。

GDETO举办了有益于香港企业业务发展的研讨会,并邀请地方当局的代表或各行各业的专家对香港商人关注的政策或问题进行阐述。这些研讨会帮助港商更好地了解五个省/地区的最新运作情况。

投资香港服务中心

GDETO成立了一个投资香港服务中心,为来自五个省/地区的企业提供有关在香港投资的免费咨询服务。

贸易考察团

GDETO组织贸易考察团,使来自五个省/地区的潜在投资者能够了解最新的贸易环境,与政府官员、专业团体、贸易和工业组织成员交流信息,并增强他们对在香港投资的信心。

内地企业赴港投资/午餐/晚宴研讨会

GDETO不时组织各种类型的投资促进活动。例如,个人咨询、圆桌会议、研讨会、交流论坛、午餐/晚宴等。涉及的话题包括各行业投资环境、签证申请、融资和上市等。这些活动旨在为有意在香港投资或已经投资或设立公司的内地企业提供一个交流平台,让他们与相关工业和服务业的专家/专业人员进行讨论。以便加深他们对香港投资环境的了解。

资源中心

GDETO建立了一个资源中心,收集了与五个省/地区和香港有关的最新贸易相关信息。

综合贸易信息平台

GDETO与五个省政府及其主要城市的网站建立了超链接,使公众能够了解最新的贸易和经济情况。

如果您遇到相同的问题,请尽快与我们联系。

您可能想要了解:自 2016 年以来,中国简化了公司注册流程

如果管理公司的库存

保证库存记录准确对一个企业的成功运营至关重要。如果没有准确的记录,一方面,很大程度上容易惹恼您的客户,并增加货物销售成本,最终造成利润损失;另一方面,库存记录的准确使管理人员能够更好了解市场趋势并预测未来的客户需求。

保持理想的库存水平

保持更新库存记录可以通知您何时需要订购新的项目。库存不足时,没有足够的产品发送给客户;同时,库存过剩时,仓库积压太多,造成混乱,有时积压的易腐物品导致浪费,造成成本增加。在一段时间内分析库存记录可以帮助您了解市场趋势,以预测哪些商品比其他商品卖得更快。

提升客户满意度

如果一个公司缺乏准确的库存记录,会造成很多混乱,会像滚雪球一样越滚越大。当客户选择与您合作,在下订单时一定是期望能获得优质的服务。如果你不能满足客户的期望或者没有足够的库存来交付,这不仅令客户心烦意乱,还会直接影响你们之间的合作关系。这可能会导致客户可能在未来没有订单预定。此外,不满意的客户可能会与同行传播一些负面消息,所以保持准确的库存记录也很有必要。

提高员工满意度

保留准确的库存记录可能让您的员工将更多的时间投入到其他领域。因为处理一些不准确的记录可能会很耗时,但是准确的记录能让您的工作人员提高生产力和效率,更好完成工作。

会计报告不准确

企业不更新其资产负债表和损益表有可能导致无法正常反映企业的财政运营状况。由于库存信息过时,导致库存成本出现偏差,利润报告不准确。

如何在会计报表中防止库存记录不准确?

为了确保您的公司的库存是准确和最新的,您可能需要学习如何跟踪存货。那有什么方法可以追踪?举个例子,您可以简单地使用带有3个单独页面的excel文件来记录,将这3个文件命名为进货记录、期初记录和销售记录,接下来,您需要手动记录,从期初余额及进货额中扣除销售额,您就可以得到准确的库存月了。

如果计算仍然让您感到困惑。请聘请我们协助您的会计工作,我们将在整个过程中为您提供指导。

如果您遇到相同的问题,请尽快与我们联系。

您可能想要了解:香港会计和审计清单

YOUR CHINA MOBILE NUMBER and BANK ACCOUNTS in CHINA

Smart phones allow you to keep in touch with others when you are on the go. While the technology has been more advanced, the phone numbers has been used for phone banking and authentications for personal data and apps. You can now carry out daily tasks from just your fingertip. For instance, mobile-banking. In China is very common to verify your personal identity via your phone as well. Linking your bank account to Alipay or WeChat Pay accounts. Then you can pay and receive money via your phone.

What happen if your China mobile number was suspended or cancelled? How to reset your Alipay or WeChat Pay and other apps. In fact, before resetting your account you will need to activate your mobile number as the very first step.

China Number Expired Less than 90 days

If you are just owing the telephone bill for less than 90 days. Once you top up your phone again, your number can be activated in 2 days. Get a friend in China to help topping up the mobile fee. Leaving extra amounts in the account, so you will not have the same problem again until your next visit to China.

China Number Expired Over 90 days

Unfortunately, if your number is expired for more than 90 days. Then your China number will be fall into a “Frozen stage”. No matter if you have settled the outstanding fees and top up extra funds to your China number. Your number cannot be activated unless you travel into China and apply for re-activation in person. The mobile companies will need to run through a ‘true person’ registration again, taking picture, recording your traveling documents or ID on the spot.

How to re-activate?

You have to visit and report your suspended mobile number to the China local operator office in person. Also, you have to bring your personal identity card or travel documents ( Passport and China Visa). Then the operator officer will verify your identity and review and assist to arrange re-activation. This normally takes 3 to 5 days.

What happen if you don’t report to your mobile operator office?

If your number is in “Frozen stage” and not reported to your local operator office. All information related to your number will be removed. Operator can resell your number to the public. All your mobile banking, apps or wechat that you registered your China number with, might be suspended as well. You will need to apply for a new number when you return into China and approach banks. For business owners, you will also be required to go in person to the tax department and government offices to update your new number in person.

A friendly reminder, please don’t forget to top up your China mobile number. Even you are not in China, get a friend to help topping up.

For further information, please contact us.

You may want to read: How to use mobile banking in DBS IDEAL

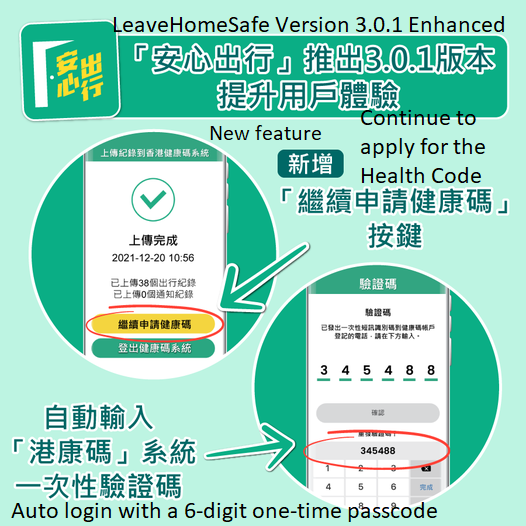

MOBILE APP LEAVEHOMESAFE VERSION 3.0.1 ENHANCED

The LeaveHomeSafe mobile app version 3.0.1 is available on 21December, 2021 with new functions to enhance user experience. The mobile app’s new version will feature new functions that enable users to log in to the Hong Kong Health Code system more conveniently. Thus, streamlining the application process of the health code.

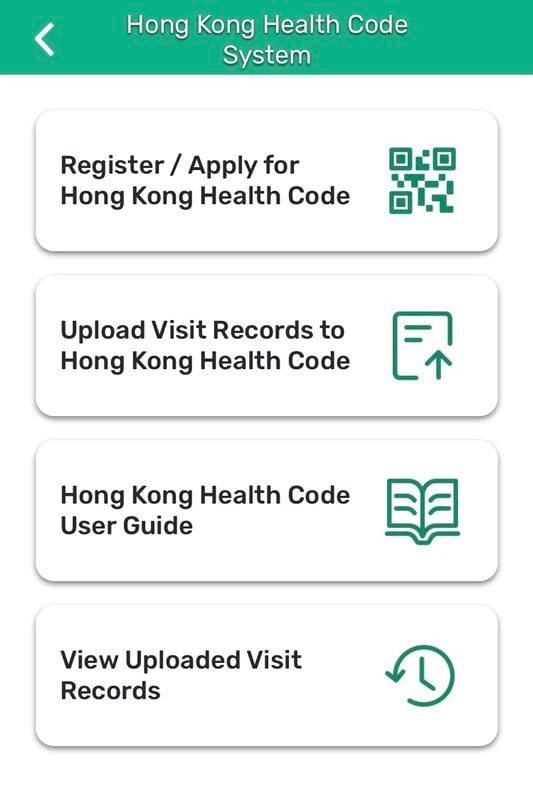

LeaveHomeSafe to Hong Kong Health Code Website

After uploading visit records through the LeaveHomeSafe mobile app to the health code system. Users can press a new button to access the Hong Kong Health Code website. And continue to apply for the code without the need to re-enter the password.

In addition, after receiving the six-digit one-time passcode through SMS. Mobile users can enter the passcode automatically with just one click, without further manual input.

For further information, please contact us.

You may want to read: INTRODUCTION TO HONG KONG HEALTH CODE

移动应用程序离开家3.0.1版增强

LeaveHomeSafe移动应用3.0.1版将于2021年12月21日推出,其新功能将增强用户体验。新版本的手机应用将增加新的功能,让用户更方便地登录香港健康码系统。从而简化了健康守则的申请流程。

LeaveHomeSafe到香港健康守则网站

通过LeaveHomeSafe手机应用将来访记录上传到健康码系统后。用户可按一个新按钮进入“香港健康守则”网站。并继续申请代码,无需重新输入密码。

另外,在收到6位数字的一次性密码后通过短信发送。手机用户只需点击一下,就可以自动输入密码,无需进一步手动输入。

如需进一步信息,请与我们联系。

你在中国的手机号码和银行账户

当你忙碌的时候,智能手机可以让你与他人保持联系。虽然技术已经更加先进,但手机号码已经被用于手机银行和个人数据和应用程序的认证。你现在可以用指尖完成日常工作。例如,小山。在中国,通过手机验证个人身份也很常见。将您的银行账户与支付宝或微信支付账户连接。然后你可以通过手机付款和收款。

如果你的中国手机号码被暂停或取消,会发生什么?如何重置您的支付宝或微信支付和其他应用程序。事实上,在重置你的帐户之前,你需要激活你的手机号码作为第一步。

中国号码过期时间小于90天

如果你欠了不到90天的电话费。一旦您再次充值,您的号码可以在2天内激活。找一个在中国的朋友帮忙充值话费。在账户中留下额外的金额,这样你就不会再遇到同样的问题,直到你下次访问中国。

过期超过90天

不幸的是,如果您的号码过期超过90天。然后你的中国号码就会进入“冻结阶段”。不管你是否已经结清了未付的费用,并为你的中国号码补充了额外的资金。您的号码不能激活,需要您亲自到中国申请重新激活。移动通信公司将需要重新进行“真人”登记,拍照,记录你的旅行证件或身份证现场。

如何重新激活?

您必须亲自到中国当地话务处访问并报告您被暂停的手机号码。另外,你必须带上你的个人身份证或旅行证件(护照和中国签证)。然后操作员会核实你的身份,审核并协助安排重新激活。这通常需要3到5天。

如果您不向您的移动运营商办公室报告会发生什么?

如果您的电话号码处于“冻结阶段”,并且没有向您当地的接线员办公室报告。所有与您的号码相关的信息将被删除。运营商可以把你的号码转卖给公众。您所有的手机银行、应用程序或您注册中国号码的微信也可能被暂停。当你回到中国和银行联系时,你需要申请一个新的号码。对于企业主,您还需要亲自到税务部门和政府办公室更新您的新号码。

友情提醒,请不要忘记给您的中国手机号码充值。即使你不在中国,也可以找个朋友帮忙充值。

如需进一步信息,请与我们联系。

WHAT IS “GREATER BAY AREA”?

Greater Bay Area

The full name is the Guangdong-Hong Kong-Macao Greater Bay Area. This comprises the two Special Administrative Regions of Hong Kong and Macao, as well as the 9 municipalities of Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing in Guangdong Province.

Aims

Hence the development of the Greater Bay Area is accorded the status of key strategic planning in the country’s development blueprint, having great significance in the country’s implementation of innovation-driven development and commitment to reform and opening-up.

The objectives are to further deepen cooperation amongst Guangdong, Hong Kong and Macao, fully leverage the composite advantages of the three places, facilitate in-depth integration within the region, and promote coordinated regional economic development, with a view to developing an international first-class bay area ideal for living, working and travelling.

What is the Outline Development Plan?

In summary, the “Outline Development Plan” has formulated 5 strategic orientations:

Not only a vibrant world-class city cluster, but also an international innovation and technology hub with global influence. Importantly, support for the construction of the “Belt and Road” initiative on international trade, travel and communication between Countries. Also, to create a demonstration zone for in-depth cooperation between the Mainland and Hong Kong and Macao. In conclusion to build a quality living circle that is suitable for living, working and travel.

For further information, please contact us.

You may want to read: 2021 POLICY ADDRESS HIGHLIGHT ON THE HONG KONG ECONOMY

什么是“大湾区”?

大湾地区

全称是粤港澳大湾区。香港特别行政区包括香港、澳门两个特别行政区,以及广东省的广州、深圳、珠海、佛山、惠州、东莞、中山、江门和肇庆9个市。

目标

因此,建设大湾区是国家发展蓝图中的重点战略规划,对国家实施创新驱动发展、坚持改革开放具有重要意义。

目标是进一步深化粤港澳合作,充分发挥三地综合优势,促进区域内深度融合,促进区域经济协调发展,建设国际一流的宜居、宜居、宜居的湾区。工作和旅行。

什么是发展大纲图?

综上所述,“发展大纲图”制定了5个策略性方向:

不仅是充满活力的世界级城市群,而且是具有全球影响力的国际创新科技中心。重要的是,支持“一带一路”倡议的建设,促进各国之间的国际贸易、旅行和交流。打造内地与港澳深度合作示范区。总之,构建适合生活、工作、旅游的优质生活圈。

如需进一步信息,请与我们联系。