2024-2025年将免收每年220港元的商业登记费,以及注册费将不再享有折扣。自2024年4月1日起,商业注册费为2200港元。 2024-2025年您需要支付多少费用? 以 2023-2024年计算,商业注册费总额为2000港元,另外加收征费150港元,合[…]

Author Archives: admin

RENEWAL OF HONG KONG COMPANY LIMITED

After setting up a Hong Kong Limited, the company filings do not end there. Yearly, you are required to arrange renewal of your company including annual return and profit tax return as well. Annual Return As per the rules in the Companies Ordinance, each of the Hong Kong companies has to file the Annual Return …

HONG KONG COMPANY BANK ACCOUNT KYC

With the increasingly connected world, financial crime is a growing global issue. The banking institutions will keep updating your company information regularly. The regular checking is called Know-Your-Client, you have to response the KYC properly and in a timely manner. What is KYC? KYC means Know Your Client and sometimes Know Your Customer. This check …

2024 香港建议薪俸税税率实施两级制

在2024-25财政预算案建议实施薪俸税和个人入息课税的标准税率两级制,自2024/25课税年度起生效。 根据建议的薪俸税两级制度调整后的标准费率如下: 净收益为500万美元或以下,税率保持不变,仍然是15%;当净收益超过500万美元,500万美元的税率为15[…]

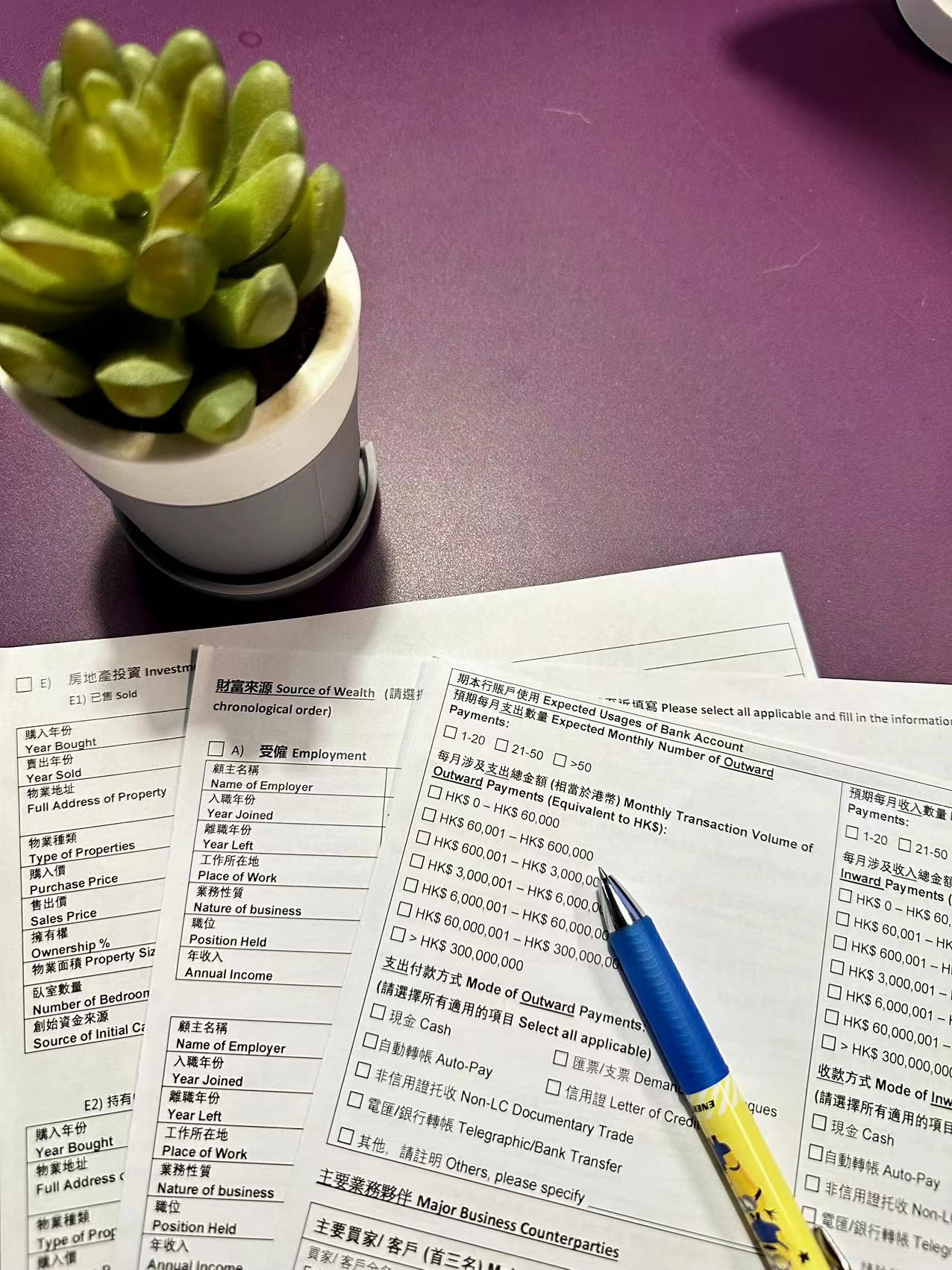

WHAT IS SOURCE OF FUNDS AND SOURCE OF WEALTH?

Financial crime is becoming critical. Entrepreneurs have to protect themselves and their businesses, which are not falling into the crime. Then we have to implement an array of Know Your Customer (KYC) measures. Hence, 2 questions must be asked, which are source of funds and source of wealth. What is Source of Funds (SoF)? SoF …

Continue reading “WHAT IS SOURCE OF FUNDS AND SOURCE OF WEALTH?”

中國公司与香港公司的贸易限制差異

中国企业一直在走向世界、拓展业务,在全世界范围寻求成功,但是在全球扩张也有比較多的贸易限制差異。 外汇管制 中国政府严格控制外汇交易,限制中国公司向国际供应商付款或从海外客户收款。因此,外汇交易通常必须通过授权银行进行,并且必须获得监管部门的批准。 关税和贸易[…]

香港公司银行开户所需资料

香港公司银行开户所需资料 1.香港公司资料:注册证书、最新商业登记证、周年申报表、法团成立表格 2.董事个人资料:身份证、通行证/护照、近3个月的银行流水 3.国内公司营业执照(满一年) 4.国内公司近三个月银行流水 5.销售/采购合同+对应合同的增值税发票 […]

WHAT IS A BRANDING KIT?

Branding Kit A brand kit is a collection of the visual elements of your brand: the colour palette, logo(s), and typography. It also known as a brand style guide or brand guidelines. It is a document that outlines the visual and stylistic elements of a brand. So branding kit serves as a reference point for …

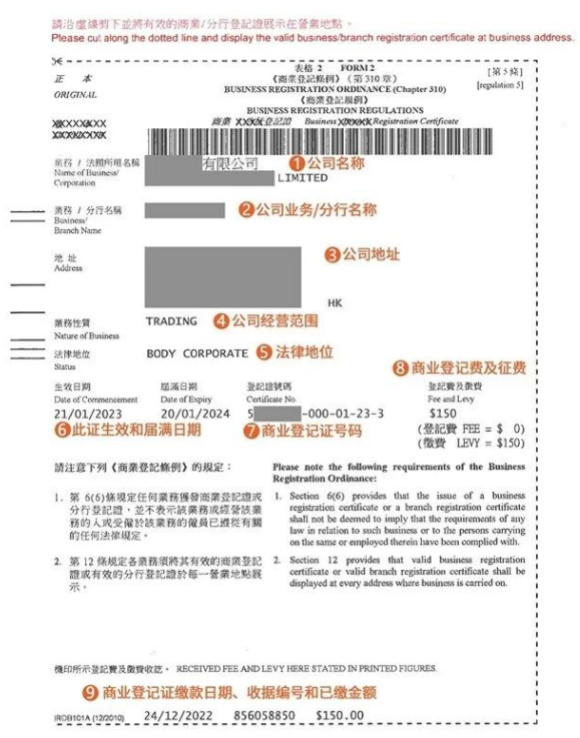

香港公司商业登记证怎么看?

香港公司商业登记证里面都包含哪些信息? 1、香港公司名称 2、公司分行名称(如有) 3、公司注册地址 4、公司业务性质(即经营范围) 5、法律地位 6、商业登记证的生效日期和届满日期 7、商业登记证编号(也叫税号,向税局报税的号码) 8、商证的登记费及征费(依[…]

HONG KONG BANK ACCOUNT OPENING – 4 STEPS ONLINE SETUP

Remote Account Opening If your business is set up in Hong Kong and your wanted to open a business bank account. Then most of the bank can provide remote account opening platform via your mobile phone app. Thus, you can apply anytime, anywhere by using the remote account opening service. Step 1 Visit your preference …

Continue reading “HONG KONG BANK ACCOUNT OPENING – 4 STEPS ONLINE SETUP”