General speaking Hong Kong is under governance of China. However, there are significant differences between a Hong Kong Limited Company and a China Limited Company. Primarily due to the distinct legal, regulatory and business environments in two difference jurisdictions.

Legal System

Hong Kong operates under a common law system. The system emphasises judicial independence, protection of property rights, and adherence to precedent.

China operates under a civil law system and influenced by socialist principles and traditions. So, the legal system is based on statutes and regulations, and judicial decisions do not have the same binding authority as in common law systems.

Corporate Governance

Hong Kong Limited companies adhere to corporate governance standards that emphasize transparency, accountability, and shareholder rights. Thus, Hong Kong Companies should follow the regulations set by the Hong Kong Companies Ordinance.

China Limited companies are subject to corporate governance regulations set by the Chinese government, including the Company Law of the People’s Republic of China and other relevant regulations issued by authorities such as the State Administration for Market Regulation (SAMR).

Foreign Investment Restrictions

Hong Kong has no restrictions on foreign ownership or investment in limited companies. Then the foreign investors can establish wholly-owned subsidiaries or joint ventures without the need for a local partner.

Foreign investment in certain industries has restrictions in China. Or require the involvement of Chinese partner through joint ventures in China. Also, the Chinese government regulates foreign investment through measures. For instance, the Catalogue of Industries for Guiding Foreign Investment.

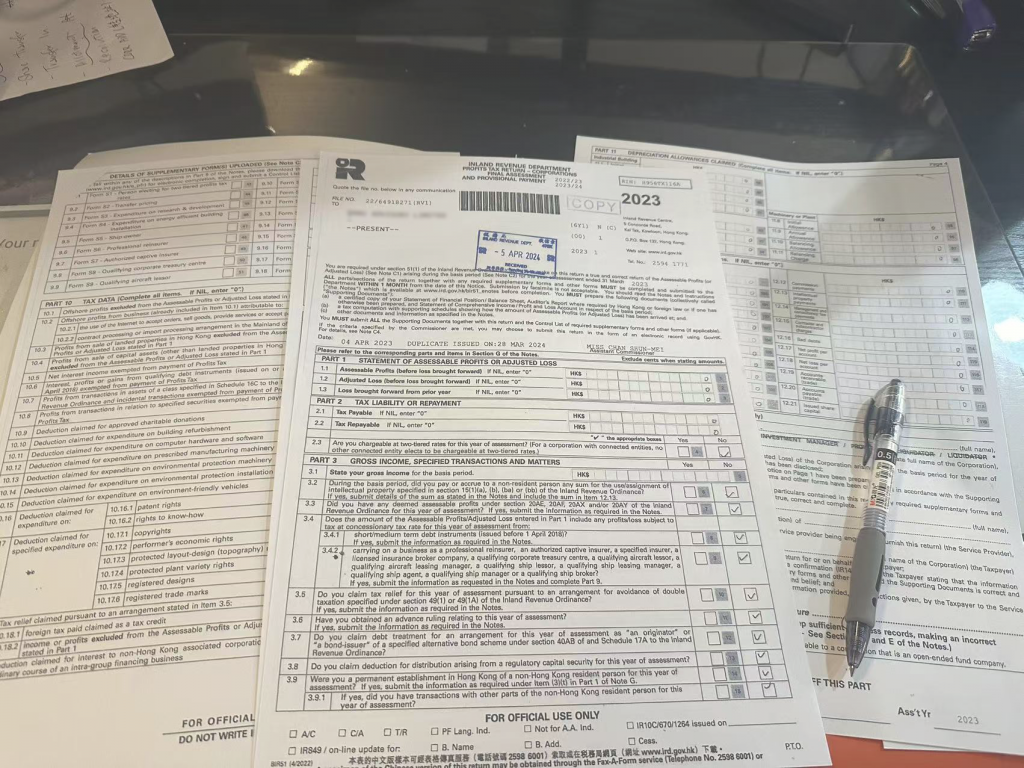

Taxation

Hong Kong has a simple and low-tax regime, with a flat corporate tax rate (currently capped at 16.5%). Furthermore, there is no tax on dividends, capital gains, or interest income earned outside of Hong Kong.

China has a more complex tax system, with corporate income tax rates ranging from 15% to 25% depending on the type of company and location. Additionally, companies operating in China may be subject to value-added tax (VAT), business tax, and other taxes.

Currency and Capital Controls

Hong Kong operates under a free-market system with a freely convertible currency (HKD) and no significant capital controls. While China imposes restrictions on currency exchange and capital flows, and the Chinese Yuan (CNY) is subject to government controls and managed exchange rates.

Market Access

Hong Kong is famous for its open and international market, providing access to global investors, financial institutions, and capital markets. And China has a large and growing domestic market. But also maintains various regulatory barriers and licensing requirements for foreign companies operating in certain sectors.

Centre O highlighted some of the key differences between Hong Kong Limited Companies and China Limited Companies. When deciding where to establish a company. You better to think deep and a few steps forwards.

For further information, please contact us.

You may want to read: Advantages and disadvantages of a Limited Company – a summary